irs unemployment tax break refund status

Return received refund approved refund. Adjusted gross income and for unemployment insurance received during 2020.

Tax Season Is Not Over Until You File Tackk Tax Season Tax Services Tax

What is the status on the unemployment tax break.

. Use the Refund Status link to go to the IRS Refund Status Online Tool just have your 2015 Tax folder ready so you can find the required information. 22 2022 Published 742 am. These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset the debt.

People who received unemployment benefits last year and filed tax returns on that money could receive the extra funds the IRS said in a press release. Said it would begin processing the simpler returns first or those eligible for up to 10200 in excluded benefits and then would turn to returns for joint filers and others with more complex returns. If the IRS determines you are owed a refund on the unemployment tax break it will automatically send a check.

Use the NJ Refund Status link to go to the New Jersey State Income Tax Refund Status Online Tool just have your 2015 Tax folder ready so you can find the required information. The exact refund amount will depend on the persons overall income jobless benefit income and tax bracket. The American Rescue Plan Act allows eligible taxpayers to exclude up to 10200 up to 10200 for each spouse if married filing jointly from their gross income which will likely lower the tax liability.

See reviews photos directions phone numbers and more for Irs Tax Refund locations in Piscataway NJ. The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020. This includes unpaid child support and state or federal taxes.

The unemployment tax refund is only for those filing individually. The agency had sent more than 117 million refunds worth 144 billion as of Nov. You can try the IRS online tracker applications aka the Wheres My Refund tool and the Amended Return Status tool but they may not provide information on the status of your unemployment tax refund.

The tax break is for those who earned less than 150000 in. At this stage unemployment compensation received this calendar year will be fully taxable on 2021 tax returns. The IRS has identified 16 million people to date who may qualify for an associated tax refund or other benefit.

The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from unemployment benefits. The tax refund for the unemployment compensation exclusion is being calculated and sent by the IRS starting in May and then throughout the summer months for all the taxpayers who are eligible. The 10200 tax break is the amount of income exclusion for single filers not the amount of the refund.

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer. Not the amount of. The refunds are being sent out in batchesstarting with the simplest.

Since May the IRS has been making adjustments on 2020 tax returns and issuing refunds averaging around 1600 to those who can claim an unemployment tax break. Whether you owe taxes or youre expecting a. The first 10200 of 2020 jobless benefits 20400 for married couples filing jointly was made nontaxable income by the American.

The 10200 is the amount of income exclusion for single filers not the amount of the refund. The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in. If the IRS determines you are owed a refund on the unemployment tax break it will automatically correct your return and send a refund without any additional action from your end.

The 10200 tax break is the amount of income exclusion for single filers. My unemployment actually went to my turbo card. The first refunds are expected to be issued in May and will continue into the summer.

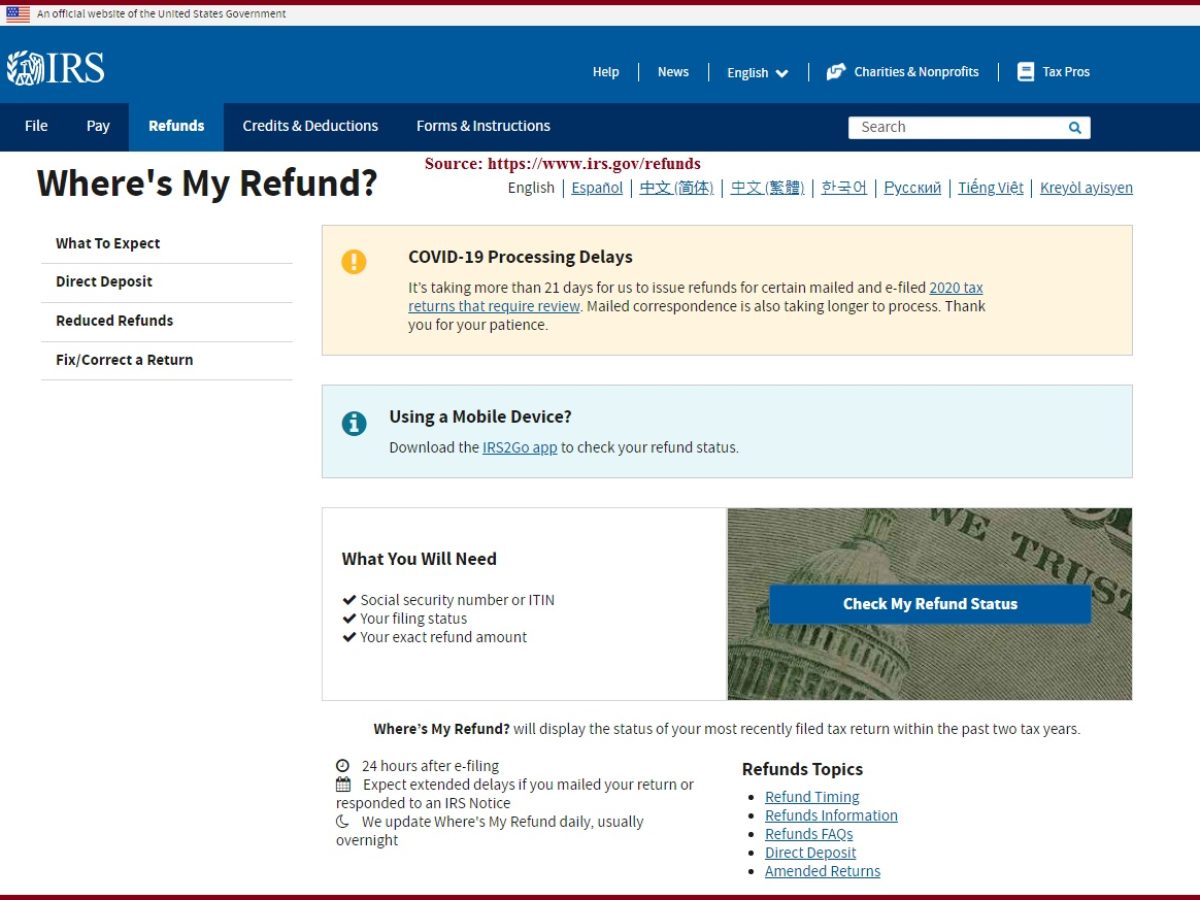

So far the refunds have averaged more than 1600. For the latest information on IRS refund processing see the IRS Operations Status page. You wont be able to track the progress of your refund through the IRS Get My Payment tracker the Wheres My Refund tool the Amended Return Status tool or another IRS portal.

This is available under View Tax Records then click the Get Transcript button and choose the. Billion for tax year 2020. Unemployment tax refund status.

WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns. But the unemployment tax refund can be seized by the IRS to pay debts that are past due. Updated March 23 2022 A1.

Why is my IRS refund taking so long. The IRS has sent letters to taxpayers. TurboTax receives no information from the IRS concerning any type of tax refund.

What are the unemployment tax refunds. The IRS has issued more than 117 million special unemployment benefit tax refunds totaling 144. You wont be able to track the progress of your refund through the IRS Get My Payment tracker the Wheres My Refund tool the Amended Return Status tool or another IRS portal.

If the IRS determines you are owed a refund on the unemployment tax break it will automatically send a check. By Anuradha Garg. Check For The Latest Updates And Resources Throughout The Tax Season.

In most cases if you already filed a 2020 tax return that includes the full amount of your unemployment compensation the IRS will automatically determine the correct taxable amount of unemployment compensation and the correct tax. If you paid more than the correct tax amount the IRS will either refund the overpayment or apply it to other outstanding taxes owed. Taxpayers should not have been taxed on up to 10200 of the unemployment compensation.

IR-2021-159 July 28 2021. The American Rescue Plan Act which was signed on March 11 included a 10200 tax exemption for 2020 unemployment benefits. The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020.

The exemption which applied to federal taxes meant that unemployment checks sent during the pandemic werent counted as earned income. These updated FAQs were released to the public in Fact Sheet 2022-21 PDF March 23 2022. Will I receive a 10200 refund.

Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. If those tools dont. Check the status of your refund through an online tax account.

Since may the irs has issued more than 87 million unemployment compensation tax. Another way is to check your tax transcript if you have an online account with the IRS. If the IRS determines you are owed a refund on the unemployment tax break it will automatically send a check.

Its taking more than 21 days for IRS to issue refunds for certain mailed and e-filed 2020 tax returns that require review And in some cases this work could take 90 to 120 days. You wont be able to track the progress of your refund through the IRS Get My Payment tracker the Wheres My Refund tool the Amended Return Status tool or another IRS portal.

Unemployment Tax Refund Update What Is Irs Treas 310 Weareiowa Com

Irs Tax Refunds Who Is Getting Irs Compensation Payments Marca

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Tax Tips Bookkeeping Services Irs Taxes Tax Preparation

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Unemployment Tax Refunds May Not Arrive Until Next Year Warns Irs

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Irs Has Sent 6 Billion In Stimulus Payments Just In June Here S How To Track Your Money Personal Loans Loan Types Of Loans

Pin On Cnet Irs And Gov Programs Convid19

Your Tax Return Is Still Being Processed Irs Where S My Refund 2022

Irs Tax Refunds Who Is Getting Irs Compensation Payments Marca

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year Gobankingrates

Irs Sending Out 4 Million Surprise Tax Refunds This Week Wpri Com